Donald Trump and his allies continue to complain that the central bank isn’t inflating the money supply enough. Last week, Bill Pulte, Trump’s appointee to the Federal Housing and Finance Administration—and the head of Fannie and Freddie—complained that Powell and the FOMC weren’t forcing down interest rates enough.

Pulte wrote on X/Twitter:

Because President Trump has crushed inflation, Fed Chairman Jerome Powell needs to lower interest rates today, and if not Chairman Powell needs to resign, immediately. Fannie Mae and Freddie Mac can help so many more Americans if Chair Powell will just do his job and lower rates.

With these comments, Pulte is demonstrating that he, like his boss Donald Trump, subscribes to the standard Yellen-Bernanke inflationist model of monetary policy: the job of the central bank is to forever force down interest rates, churn out more easy money, and devalue the currency.

Pulte claims publicly that this somehow makes homes more affordable. As we’ll see below, though, the Fed’s easy-money policy of recent decades has not made home more affordable. Rather, Fed policy has helped to relentless increase home prices through the Fed’s asset purchases, interest rate policy, and monetary inflation.

Although Pulte is engaging in performative protests against “too-high” interest rates, it is more likely he is being motivated by the usual crony “capitalist” agenda: press for more monetary inflation so Wall Street will enjoy the fruits of more asset-price inflation.

Of course, that’s just speculation. But, his actual motivations are immaterial to the fact that following the recommendation of Trump, Vance, Pulte, et al, will only continue to blow up a housing bubble and place housing ever more beyond the reach of ordinary people.

Do Falling Interest Rates Increase Home Prices?

There is a fairly clear inverse relationship between interest rates and home prices. This is certainly obvious to real estate agents and their lobbyists who perennially lobby for lower interest rates because they know that lower interest rates lead to more home purchases and higher prices. This in turn, leads to higher commissions for agents.

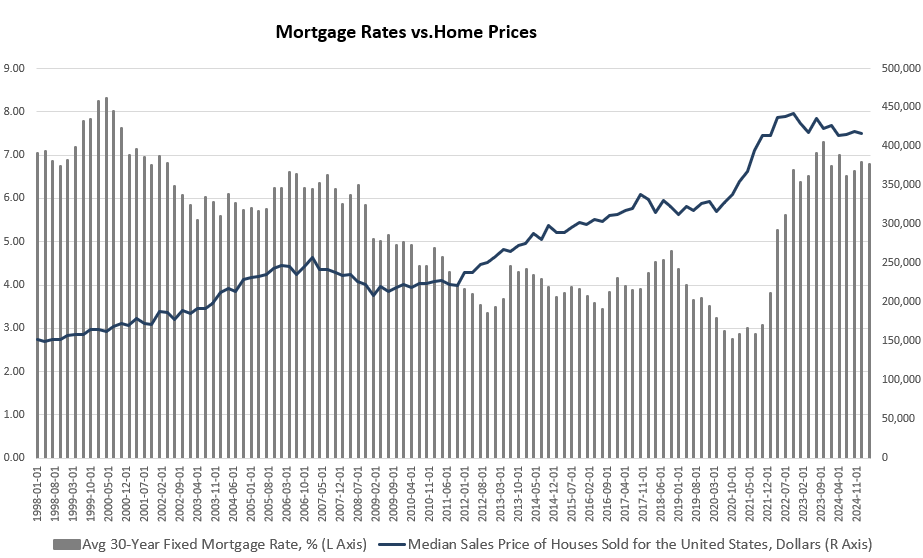

The inverse relationship is reflected in this graph:

Source: Source: US Census Bureau and Freddie Mac.

There are many factors that affect mortgage rates, of course, but over the past thirty years—and especially since 2009—falling interest rates have coincided with rising home prices. In fact, falling interest rates slightly precede rising home prices, suggesting a causal relationship.

It’s easy to picture how falling interest rates lead to higher prices. When mortgage rates are low, it is easier to afford monthly payments on, say, a $300,000 mortgage. At three percent, the monthly payment is about $1700 per month. At six percent, though, the payment on the same mortgage is nearly $2300 per month. Clearly, there are more potential buyers for the house at the lower interest rate.

But there are important monetary reasons that explain why low interest rates drive prices higher. In the modern context of inflationary fiat currency, lower interest rates are usually fueled by new money creation, and this monetary inflation drives more asset price inflation.

This is because central banks “set” their lower interest rates through open market operations that involve increases in the money supply. In Understanding Money Mechanics, economist Bob Murphy explains:

Specifically, when monetary base growth is high, the federal funds rate is low. And vice versa, when the growth in the monetary base slows, the fed funds rate shoots up.

There is nothing mysterious about this. To repeat, this is the standard explanation given in economics textbooks—not just Austrian texts—to explain how a central bank “sets” interest rates. When the central bank wants to cut rates, it buys more assets and floods the market with more base money. And when the central bank wants to raise rates, it slows the pace of monetary inflation (or even reverses course entirely and shrinks the monetary base).

In other words, falling interest rates are a manifestation of monetary inflation, and monetary inflation often shows up as asset price inflation. We see this reflected in home prices when the central bank works to drive down interest rates. This, of course, is also reflected in consumer price inflation, which rose to forty-year highs in 2022. It is not a coincidence that after a decade of extreme efforts to inflate home prices after 2009, consumer prices surged nearly 25 percent in only five years, from 2020 to 2025.

The Fed’s Stockpile of Mortgage Securities

The Federal Reserve has been deliberately and specifically meddling with home prices ever since Fed Chairman Alan Greenspan explicitly sought to blow up a housing bubble as a means of exiting the 2001 recession in the United States. This policy, however, reached never-before-seen levels of intervention in 2009 when the central bank directly intervened in the economy to buy up trillions of dollars worth of mortgage backed securities (MBSs). The Fed did this to force down mortgage rates and to inflate prices of MBSs as a means of bailing out major commercial banks which faced catastrophic declines in their mortgage-heavy portfolios.

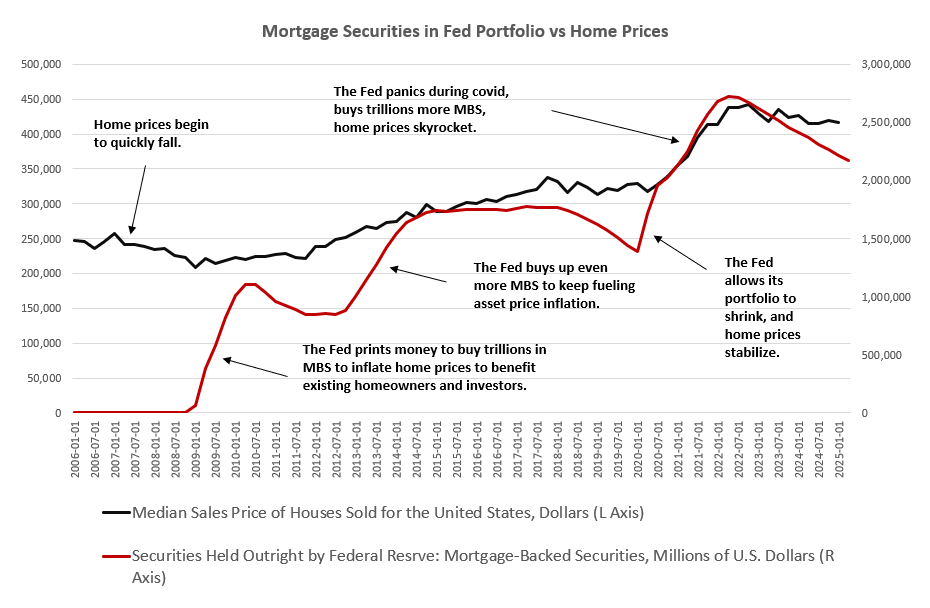

No discussion about home prices or mortgage rates captures the full context of the housing market unless we consider the effects of the Fed’s stockpile of mortgage-backed securities. So long as the fed sits on its hoard of mortgage assets, home prices are being inflated by artificial Fed-created demand for mortgages.

(Alex Pollock has examined how the Fed turned itself into the world’s largest Savings and Loan through this process.)

We can see the history of this phenomenon in the graph below. When the 2007 housing crash began, the Fed sprang into action to bail out Wall Street by buying up MBS assets. This turned around the downward trend in housing prices which would have made housing more affordable, but would also have made banks lose a lot of money. So, the Fed (and the Bush administration) decided to inflate real estate asset prices, and prices headed up again. The Fed bought up more of these assets in 2013 and 2014 to further “stimulate” asset prices and force down mortgage rates. When the Fed finally began to allow some of these assets to roll off the balance sheet in 2019, home prices finally moderated. But, the Fed started a new buying Frenzy in response to the covid panic, and home prices surged with historic speed.

Source: US Census Bureau and Federal Reserve Board of Governors.

It is true that, in recent years, the Fed has very slowly allowed some of these assets to begin rolling off the balance sheet. Not surprisingly, we have also seen home prices finally start to level off. But, the rate at which the allows this to happen is purposely extremely slow so as to ensure that home prices do not actually fall by any significant amount. Again, what comes first is concern for Wall Street. Falling home prices, of course, would be denounced as “deflation,” which the central bank eternally opposes. After all, the whole point of the Fed’s mortgage asset purchases is to make homes more expensive. That’s good for the banks which continue to benefit from the ongoing bailout that is the Fed’s asset purchase scheme.

Why Care if Home Prices Rise?

But why should we care if home prices rise? After all, as Pulte suggests, can’t “we” just make homes affordable again by lowering interest rates?

Well, it’s not that easy.

After all, if it were that easy, then we wouldn’t now be looking at housing affordability hit a multi-decade low while the average age of homeowners surges. This didn’t suddenly happen in recent weeks because—as Trump seems to think—Powell is just being intransigent.

According to the Atlanta Fed’s affordability index, affordability has fallen 45 percent since 2012, and began a precipitous decline during the first quarter of 2021—before price inflation forced the the Fed to allow interest rates to increase from historic lows. Moreover, the homeownership rate has fallen by six percent since 2004. This happened in spite of the Fed’s inflation-fueled efforts to drive down mortgage rates again and again. In fact, thanks in part to these efforts, the money supply has increased by 231 percent since the Fed began buying up mortgages in 2009.

Monetary inflation is limited by the political realities of price inflation. Eventually, people start to notice that their wealth and incomes are being inflated away. Central banks cannot just simply inflate nonstop to force down interest rates to please real estate agents and Donald Trump—at least not without imposing the devastating economic effects of price inflation.

Moreover, just driving down mortgage rates comes with other costs. As home prices increase, this can’t fixed by simply financing everything to the hilt at low interest rates. With rising home prices comes higher down payments, higher property taxes, and higher insurance costs. This can’t all just be rolled into mortgages. For many ordinary people, monthly payments raise as home prices rise, even in a low-interest-rate environment.

Unfortunately, central bankers can’t wave a magic wand and make price inflation disappear while the same central bankers also push easy money to force down interest rates. This is why we continue to see declining homeownership rates and rising debt loads as owning a home becomes ever more out of reach.