Pressure on Jerome Powell and the Federal Reserve continues to mount as both Wall Street and the White House demand more easy money to keep asset price inflation accelerating ever upward. These inflationists also hope that easy money-policy will somehow reverse the current stagnating trend in employment. In recent months, both President Trump and the usual Wall Street outlets have insisted that the Fed reduce the target policy interest rate to ensure that stock prices and real estate prices continue to skyrocket ever upward.

This is the last thing ordinary Americans need right now. Yes, continually rising asset prices are good for firms and individuals who already own large amounts of assets. These people have been pushing for lower interest rates for decades now, because lower interest rates function as a subsidy for asset owners and fuel rising asset prices. Moreover, since the late 1980s, with the Greenspan put, the Fed’s commitment to manipulating interest rates ever downward has been a boon for Wall Street hedge fund managers and investment bankers.

On the other hand, ordinary people have done less well. As home prices have spiraled upward—fueled by loose monetary policy (i.e., low-interest-rate policy) housing has become increasingly unaffordable for first-time homebuyers and middle-income families.

The politicians, pundits, and lobbyists who now advocate for the Fed to lower the target rate are basically advertising that they couldn’t care less about whether or not ordinary people can afford to buy a home. By this way of thinking, all that matters is that the wealthy asset owners get more of their low-interest subsidy and “number go up”—specifically the S&P 500—for Trump and his Wall Street allies.

Moreover, if the Fed pushes for lower rates right now—which requires more money creation from the FOMC’s open market operations—then the Fed will be “loosening into inflation.” That is, the Fed will be adopting looser, more inflationary monetary policy at the same time that there is an upward trend in price inflation. Not only are CPI and PPI prices accelerating again, but the US is in the midst of a meltup with the S&P 500 near all-time highs, with gold, crypto, and more all ripping to new highs. This is not an economy with too little liquidity. This is an economy with trillions of dollars from the covid-era mega-inflation still sloshing around the economy.

Jerome Powell is hardly a hard-money guy, and his claims that Fed policy is “restrictive” right now, must be viewed with extreme skepticism. Of course an inflationist central banker like Powell would say that his policy is restrictive even when it’s not. But Powell also fears undermining Fed legitimacy by triggering price inflation reminiscent of the 1970s—or even reminiscent of 2022 when CPI inflation hit 40-year highs. The general public in America already knows that it’s creaking under the weight of 25 percent inflation over the past five years, with no relief in sight. Powell likely knows that a return to 2022-style inflation would present significant political problems for the central bank, and he’s motivated to avoid that.

PPI and CPI Increases Show Price Inflation Isn’t Going Away

New numbers from the Federal government’s own official reports suggests that Powell and the Fed are rights to be concerned.

On Thursday, the BLS released a new report showing that producer prices surged in July. The producer price index (PPI) rose by 0.9 percent, month over month, during July. That’s the largest MoM increase since March of 2022, and it’s the seventh largest increase in PPI in more than fifteen years. The year-over-year increase in the PPI also rose to a five-month high, rising by 3.3 percent, year over year.

Moreover, the BLS’s CPI report for July shows that the year-over-year change to the CPI rose again in July to 2.7 percent. The YoY CPI has now risen three months in a row. Measured month over month, the CPI has risen four months in a row, with the CPI up by 0.2 percent from June to July.

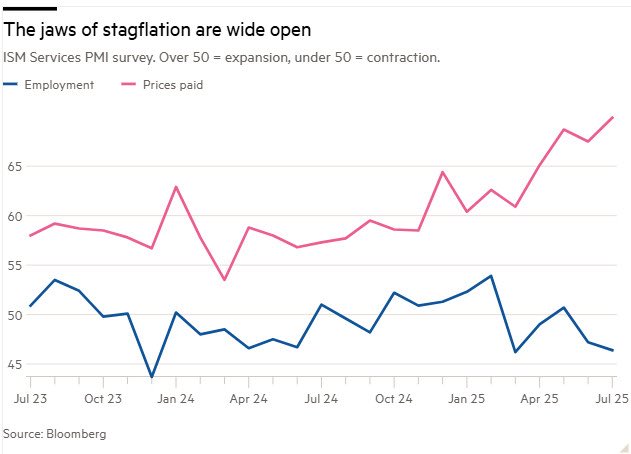

Taking all this together, we find price inflation is headed upward and not back to “the two-percent goal” as Fed economists have long insisted. Even worse, current trends suggests that the economy could be headed toward stagflation with prices stubbornly trending upward, and employment trend stagnating or worsening. A recent analysis from Bloomberg noticed this unfortunate situation:

So, with Trump and Wall Street beating the drum for even more monetary inflation, what should the Fed really be doing? The answer is: “nothing.” The last thing that regular Americans need right now is a Fed loosening policy just as CPI and PPI inflation are accelerating. And the last thing regular Americans need right now is rising home prices. Moreover, the Fed shouldn’t even be targeting any specific level for short-term interest rates—or long-term interest rates either. The Fed should simply allow markets to determine interest rates, and if that leads to rising interest rates, that will simply illustrate what a sham current interest rates are under the influence of incessant Fed meddling. Moreover, if the fed simply refrains from manipulating interest rates—which, again, is done partly with newly created money—then monetary inflation may finally be truly restrictive and consumers might finally get some relief in the form of price deflation.

Of course, we’ll also hear from the usual inflationists that a lack of Fed-fueled liquidity would lead to a worsening employment situation. Unfortunately, we’re likely to get that one way or another at this point. After more than fifteen years of “quantitative easing,” and more than a decade of ultra-low-interest-rate policy, the US is in the midst of an unsustainable “everything bubble.” This leaves us with two choices: keep the bubble going with more monetary inflation, which will mean more upward spiraling prices and unaffordable housing. Or, the Fed could step back, and allow the market to actually function, which will mean the bubbles will pop. That will lead to temporary unemployment and economic disruption. But it would also finally give regular people a chance to actually move into truly productive, non-bubble lines of work, and acquire assets at normal, non-bubble prices.

Unfortunately, the latter options will be opposed at every turn by Donald Trump, Wall Street, and the Central Bank cabal. Let’s hope that somehow, some way, they fail.

![Israeli Prime Minister showed media photos that he called "fake starving children" and said, "The only deliberate starvation policy that we see in Gaza is the starving of our [Jewish] hostages."](https://www.constitutionpatriots.com/wp-content/uploads/2025/08/UN-Dropped-Measurement-for-Famine-by-50-Giving-Media-What-350x250.jpg)