Employment data could be pointing out positive signs heading into 2026.

Initial jobless claims may have given those losing sleep at night about the US labor market some hope heading into the new year. In the second half of 2025, market watchers and policymakers have furrowed their brows over employment data, suggesting conditions were deteriorating at a fast and furious pace. But new data should assuage fears, at least until the next major report.

Loving Those Jobless Claims

The Department of Labor dropped the initial jobless claims for the week ending November 29 on December 4. These statistics measure the number of first-time applications for state unemployment benefits. Due to the government shutdown, the Labor Department did not publish the data. Still, now that Congress has reopened its doors, economic observers are getting up-to-date snapshots of the national labor market.

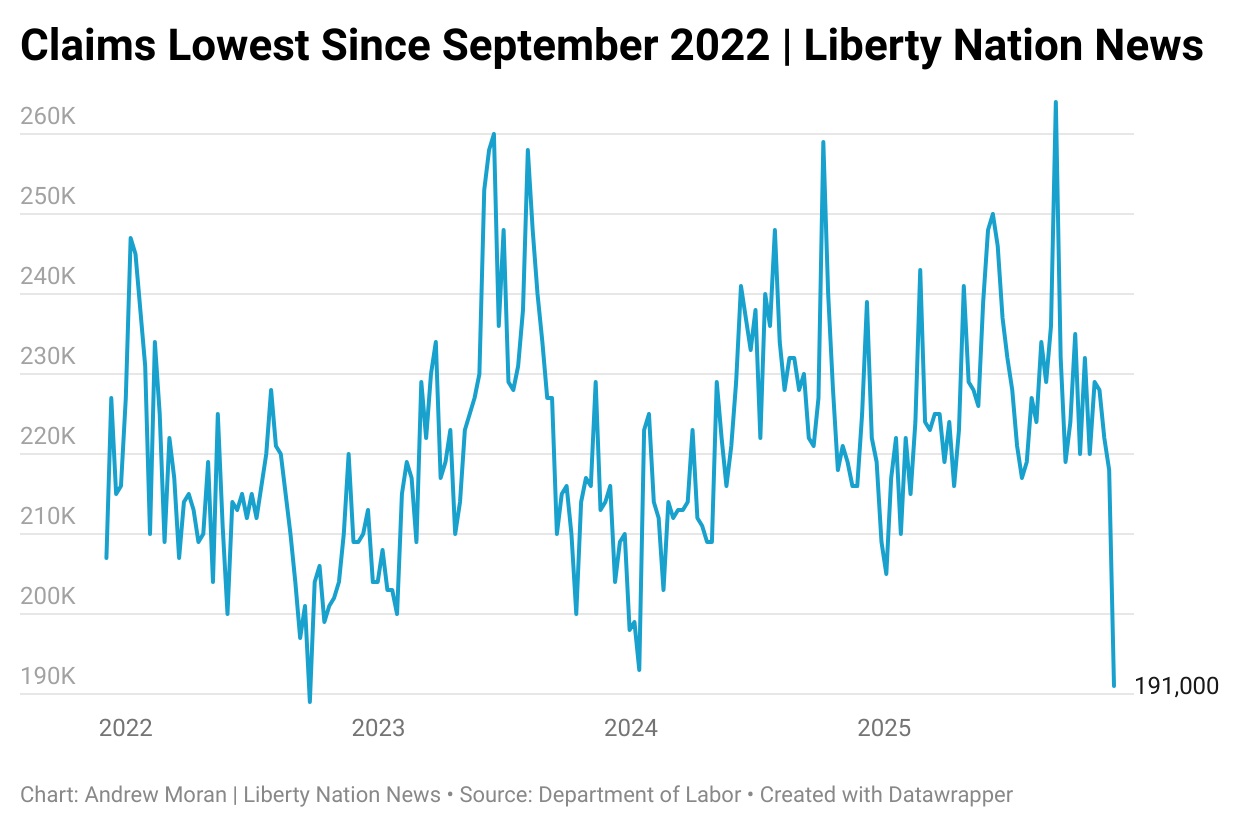

Weekly jobless claims declined by 27,000 from the previous week to 191,000. In addition to being the fourth consecutive weekly drop, the lower-than-expected reading was the lowest print since September 2022. Even recurring claims, which gauge the number of jobless benefits Americans are currently receiving, have tumbled for the second consecutive week to a two-month low of 1.939 million.

One word: Yuge.

One word: Yuge.

Some market analysts might dismiss these numbers because they are typically unstable for this time of the year. However, the four-week average, which strips out week-to-week volatility, fell by almost 10,000, to 214,750. Additionally, a chorus of economists has asserted that these claims are consistent with the low amount of actual, not planned, layoffs.

“Those job losses from other alternative measures of labour statistics may be overstating the weakness in the nation’s employment markets,” said Christopher Rupkey, chief economist at FWDBONDS, according to Reuters. “The tea leaf readers at the Federal Reserve may need to recheck their figures because it certainly does not look like economic growth is in danger of stalling out.”

Feeding the Fed

Despite the jobless claims data suggesting the US labor market may be rebounding – or is not in a horrific state as many imagine – investors still expect the Federal Reserve to lower interest rates. According to the CME FedWatch Tool, the futures market is penciling in a third straight quarter-point reduction to the benchmark federal funds rate, an influential policy rate that impacts business, consumer, and government borrowing costs.

Fed Governors Michelle Bowman, Stephen Miran, and Christopher Waller have been vocal about cutting rates in response to deteriorating employment conditions. However, other US central bank officials, like Cleveland Fed President Beth Hammack and Boston Fed President Susan Collins, have been apprehensive about easing policy further amid elevated inflation.

Minutes from the October Federal Open Market Committee meeting highlighted divergent views on the economy, data, and the direction of monetary policy in December and beyond.

To be honest, economists should be sympathetic to both views. On the one hand, nonfarm payrolls, which have been repeatedly revised downward for the past few years, might be flashing alarm bells. On the other hand, the government’s annual inflation rate is at 3%, the same level as in January. As Liberty Nation News noted, there is a case to be made for either cutting or raising interest rates.

Panic on Main Street

Not everyone is paying attention to weekly jobless claims data or the Job Openings and Labor Turnover Survey. Everyone is living their lives, and they are not confident in what they are seeing. A new Napolitan News Service survey of 1,000 registered voters found that 63% say it is at least somewhat challenging to find a job, and 47% say it is a bad time to be looking for employment.

There was a meltdown on Wall Street this past spring. Will there be panic on Main Street in the coming spring?

Liberty Nation does not endorse candidates, campaigns, or legislation, and this presentation is no endorsement.