The current administration is attempting to restore the American Dream of homeownership for younger families. Over the past few years, housing affordability has spiraled out of control, caused by a blend of Federal Reserve interventions, regulations, underbuilding, and illegal immigrants. President Donald Trump and his team are trying to reverse the cost-of-living crisis, but will the latest proposals deliver tangible results or merely chip away at sky-high home prices?

Housing Affordability – Step One

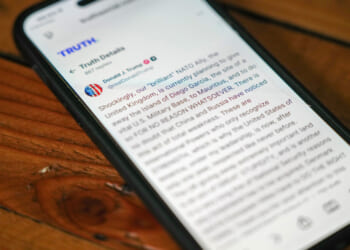

President Trump took to Truth Social and announced that he is directing his representatives to purchase $200 billion in mortgage-backed securities. “This will drive Mortgage Rates down, monthly payments down, and make the cost of owning a home more affordable,” Trump wrote on his social media platform on January 8. Bill Pulte, America’s chief housing regulator, saluted and confirmed that Fannie Mae and Freddie Mac were “on it.”

If it sounds like the Fed’s quantitative easing initiative, you would be somewhat accurate. Agency and non-agency mortgage-backed securities are simply bonds backed by home loans. Homeowners’ mortgages are bundled into one investment vehicle, and their monthly payments are passed through to investors who hold these bonds in their portfolios.

Trump’s idea is to increase demand for these mortgage bonds, raising their prices and pushing yields lower, which then sends mortgage rates downward. The president’s announcement did achieve a temporary reprieve, with the average 30-year fixed-rate mortgage plummeting below 6% on January 9 for the first time since August 2022.

However, this scheme is unlikely to accomplish long-term benefits for the housing market. It is simply a short-term remedy because it would require massive intervention on the scale of the Federal Reserve’s pandemic-era actions to accomplish far lower interest rates. The Fed bought $2.5 trillion worth of mortgage-backed securities during COVID, which brought the 30-year rate below 3%. Ultimately, it might shave off ten basis points from mortgage rates, but not lower interest rates in any meaningful way over the long term.

Consider this: The US mortgage bond market totals between $9 and $11 trillion. Put simply, this action would be a drop in the bucket in terms of impact on sizable savings for prospective homebuyers or homeowners seeking to refinance their loans.

Housing Affordability – Step Two

In a January 7 Truth Social post, President Trump announced that the United States will restrict large institutional investors from purchasing single-family homes, stating that Corporate America is preventing average Americans from getting their feet in the door.

“For a very long time, buying and owning a home was considered the pinnacle of the American Dream. It was the reward for working hard, and doing the right thing, but now, because of the Record High Inflation caused by Joe Biden and the Democrats in Congress, that American Dream is increasingly out of reach for far too many people, especially younger Americans.

“It is for that reason, and much more, that I am immediately taking steps to ban large institutional investors from buying more single-family homes, and I will be calling on Congress to codify it. People live in homes, not corporations.”

Conservatives rejoiced at the news, proclaiming that this decision would stop BlackRock from buying all the homes and locking out the young generation. The problem, however, is that it is not BlackRock supposedly purchasing residential properties all over the nation and stopping Johnny and Jenny from buying a bungalow in Biloxi, Mississippi, but rather Blackstone. Second, the Wall Street giant’s footprint in America’s real estate market is minuscule in the grand scheme.

Let’s crunch some of the numbers. According to the Census Bureau’s Housing Inventory Estimate for the third quarter, there are approximately 85 million single-family housing units. Of these, major institutional landlords own fewer than half a million, with Blackstone controlling approximately 57,000.

The next thing in this discussion is whether such an action would have any significant effect on the housing market.

First, there are many unknowns, as Treasury Secretary Scott Bessent noted at the Economic Club of Minnesota, that the administration is still crafting a blueprint, although he admitted that it would not be retroactive. Ultimately, Trump presented a concept of a plan.

Second, this sort of thing has been tried before, and it backfired on the local rental market. For example, the Netherlands restricted buy-to-rent agreements. Rotterdam, the nation’s second-largest city, banned investors from buying homes. A Dutch study found that investor-owned rental units declined, the number of homes purchased by affluent first-time homebuyers increased, and the cost of rental housing rose.

“The ban has successfully increased middle-income households’ access to homeownership, at the expense of buy-to-let investors. However, the policy also drove up rents in affected neighborhoods, thereby damaging housing affordability for individuals reliant on private rental housing, undermining some of the intentions of the law,” researchers wrote in the paper.

As it stands, just 3% of America’s rental housing stock is owned by large institutional investors. That said, it is still riveting that Blackstone shares tanked more than 5% after Trump’s social media announcement.

MAGA Chisel

Proponents will contend that these are not the primary tools the White House is using to restore housing affordability. They would be right. In its first year, the administration has presented a growing list of ideas that can allow Gen Z and younger Millennials to purchase a home without waiting until they have gray hair or the Colorado Rockies win a World Series championship. From portable mortgages to building incentives, Trumponomics has advanced many proposals.

It is vital, however, to identify why housing affordability has become the issue of the day: government regulations, Federal Reserve interventions, and the erosion of Americans’ purchasing power. These are the contributors, not entrepreneurs or Wall Street investors.