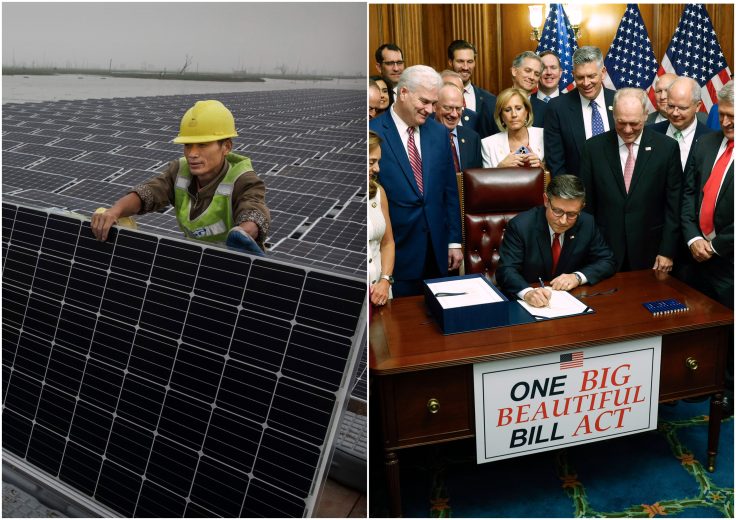

Under Trump’s One Big Beautiful Bill, companies with more than 25-percent Chinese ownership can’t claim green energy tax credits

President Donald Trump’s Treasury Department is readying guidance aimed at preventing companies with significant Chinese ownership from receiving green energy tax credits. In response, Chinese solar firms are scrambling to create corporate entities that appear American but in fact have extensive ties to China, internal industry data and research reviewed by the Washington Free Beacon shows.

Take the Ontario-based global solar panel maker Canadian Solar. The company’s U.S.-based manufacturing and sales were long overseen by Canadian Solar’s Chinese subsidiary, CSI Solar. In December, Canadian Solar announced plans to resume direct oversight of its U.S. operation through a new joint venture. On paper, the move appeared to reflect a North American company making efforts to reshore its supply chain. Upon closer examination, Canadian Solar’s China ties remain strong.

The company’s founder and CEO, Xiaohua Qu, served as a committee member in the Chinese People’s Political Consultative Conference, a Chinese Communist Party-controlled government advisory body. In a 2012 interview with the state-run propaganda outlet China Daily, he referred to economies outside of China as “foreign markets” and said his “intention” as the head of Canadian Solar was to “focus on the Chinese market.” The majority of Canadian Solar’s assets and employees are based in China, as the company notes in its financial statements, which concede that it is exposed to legal and operational risks because “a significant portion of our manufacturing operations” are in the communist nation. The statements also note that Beijing considers six of Canadian Solar’s Chinese subsidiaries to be “high and new technology enterprises,” which are eligible for favorable tax rates.

Canadian Solar could nonetheless receive green energy tax credits courtesy of the U.S. taxpayer. Trump’s One Big Beautiful Bill Act—which the Treasury Department’s impending guidance is meant to enforce—stipulates that a company is ineligible for such credits if its Chinese ownership is 25 percent or more. Under its new structure, Canadian Solar’s Chinese subsidiary will hold a 24.9-percent stake in its U.S. operations.

Other Chinese solar firms are making similar moves, suggesting a coordinated effort to ensure China keeps its grip on a solar supply chain that it has dominated for years, experts told the Free Beacon.

“The Trump administration’s trade policies are increasingly and effectively barring China from accessing the U.S. market,” said Coalition for a Prosperous America executive vice president Nick Iacovella. “So there’s really only one option left for the Chinese, which is, ‘If we can’t import our product at an undervalued price and undercut U.S. producers, we have to come to the U.S. market, invest in the U.S., and take down the U.S. industry from within.’ That is an absolutely massive threat.”

In addition to Canadian Solar, there’s the Texas-based firm T1 Energy, which says it’s “building an integrated U.S. supply chain for solar and batteries.”

The company formed in 2025 after it purchased a solar facility in Austin from Trina Solar, a Chinese solar giant that received a roughly 10-percent stake in T1 Energy as part of the deal. Within months, Trina’s stake rose to nearly 17 percent, and the Chinese company placed its director, Mingxing Lin, on T1’s board. T1 also entered into a number of technology licensing agreements with Trina, making it largely dependent on its Chinese partner.

As a result, T1 acknowledged late last year that it may be in violation of the Trump administration’s impending foreign entity-of-concern rules and vowed to keep Trina’s stake under 25 percent. To do so, it reached an agreement to license Trina’s technology not from Trina directly, but from a company in Singapore. It’s the same tech, but because it doesn’t come from China, T1 said it “believes” it will not violate the Trump administration’s rules. Company spokesman Russell Gold said Trina “has no control over T1 Energy, period.”

A third manufacturer, the Houston-based SEG Solar, calls itself a “robust American solar company” and uses the American flag in its logo. But the company was first created as a subsidiary of Chinese firm Jiangsu Seraphim. While it claimed to have branched off to operate independently in 2023, that doesn’t appear to be the case: The company appears to operate a Chinese subsidiary, SEG Solar Jiangsu, that has sent 52 import shipments from Shanghai to SEG Solar’s Houston facilities, according to industry data gathered by S&P Global. A 2021 announcement listed SEG Solar’s president, Jun Zhuge, as SEG Solar Jiangsu’s chairman.

Additional examples include Illuminate USA, an Ohio-based company that calls itself a “leading U.S. solar panel manufacturer” but is in fact structured as a joint venture involving Chinese solar panel behemoth LONGi. California-based Sinotec Solar also brands itself as a “premier U.S. solar manufacturer.” Its CEO and director is Guangming Jin, who serves on the board of the state-run China Power International Development’s subsidiary in Nigeria.

For Nathan Picarsic, the cofounder of the Washington, D.C., supply chain research firm Horizon Advisory, China’s work to infiltrate the U.S. solar market shows that the Trump administration should issue more robust guidance that disqualifies companies seeking to hide their Chinese ties from receiving U.S. taxpayer funds.

“We have countless examples where Chinese actors are able to control the behaviors and decision-making of entities by being a dominant customer or dominant supplier of them and by having regulatory access from the Chinese side, where China’s developed a whole suite of regulatory and legal regimes that extend extraterritorially from Beijing,” Picarsic told the Free Beacon.

“These cases demonstrate that you need to move beyond just the ownership criteria because there are all these other ways that the Chinese government and the appendages of these Chinese companies can exert influence over an entity, even one that’s domiciled outside of Beijing’s borders,” he added.

Canadian Solar, LONGi, Sinotec Solar, and SEG Solar did not respond to requests for comment.