What would Milton Friedman say?

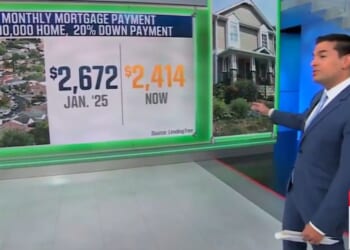

Almost two dozen states are currently embroiled in a debate as some governors and lawmakers wish to dismantle or lower property taxes. At a time when many jurisdictions are facing deficits and rising bills, can these states afford to eliminate a key funding source? Florida thinks it can.

Ron DeSantis Starts Property Tax Debate

Florida Gov. Ron DeSantis (R) wants to eliminate or reduce property taxes on primary residences, which could make the Sunshine State the first in the country to have no income tax and no property tax on homes. While he initially proposed putting the kibosh on all property taxes, he met lawmakers halfway and agreed to remove the levy only on homestead properties.

DeSantis, who could be considering a second presidential run in 2028, agreed that 29 counties would lose approximately $250 million in annual revenue. However, according to the GOP governor, this loss could be offset by cutting government waste and bureaucratic red tape or by coming to his desk to ask for funding to plug any gaping holes in their budgets.

As both sides of the aisle debate this plan, other states are considering emulating DeSantis’ proposal – or, at the very least, reducing these burdens on homeowners.

If DeSantis and others can get away with abolishing property taxes while keeping government-run services operating without a hitch, it would be a win for everyone. However, if eliminating a critical revenue source fails and requires the government to raise other taxes, it is worth discussing what legendary economist Milton Friedman argued a few decades ago.

The Henry George Principle

Appearing at the Americanism Educational League’s 51st Anniversary Dinner in February 1978, Friedman discussed the subject of whether tax reform was possible. In an exchange with an audience member, Friedman said something that will live on forever in economics: “The least bad tax is the property tax on the unimproved value of land.”

The next least bad tax, Friedman noted, is a flat tax rate on income above an exemption.

Friedman’s contention derives from the 19th-century economist Henry George, who argued in his 1879 book, Progress and Poverty, that land should be taxed rather than capital or labor. This, George explained, is because the land’s value arises from the community instead of individual effort. The land value tax, meanwhile, could be dedicated to public services instead of harming economic productivity.

George was not an advocate of aggressive taxation – quite the opposite. Instead, he believed the government should finance itself from only a single tax. Other methods, he purported, would adversely affect productive behavior. In other words, taxing income diminishes individuals’ desire to earn income. At the same time, if a land were taxed, the supply would not diminish.

Of course, left-leaning economists, such as Joseph Stiglitz, have exploited George’s assertions by pontificating that government investments raise land values, which can then boost property taxes.

At a time when all three levels of government impose confiscatory punishments at the behest of politicians and bureaucrats, a property tax would be a more pragmatic approach to tax policy, covering the bare necessities provided by the government, such as fire services and schools. Consider Friedman’s grievances with the primary forms of taxation:

“The income tax is a far worse tax … With respect to the income tax, we’ve arranged it so it’s taken off bit by bit and it’s almost painless. With respect to the sales tax, we pay a little bit of it each time. With respect to the corporate tax and excise taxes, they’re hidden in the price of things we buy. We don’t even know we’re paying them.”

Floritopia

Despite arguments for and against a property tax, DeSantis is manufacturing a conservative and libertarian utopia in Florida, one characterized by smaller government, lower taxes, and less wokeism. The next stage of Florida becoming the happiest place in the Land of the Free – the coup de grace, if you will – is dismantling property taxes. As Friedman also famously said, “I am in favor of cutting taxes under any circumstances and for any excuse, for any reason, whenever it’s possible.”

Liberty Nation does not endorse candidates, campaigns, or legislation, and this presentation is no endorsement.