The current level of government deficits will either result in inflation or an unsustainable debt burden, economists say, depending on how the government funds them.

“There are only two ways you can finance a deficit,” Steve Hanke, economics professor at Johns Hopkins University who served on President Ronald Reagan’s Council of Economic Advisers, told The Epoch Times.

“One way is to sell bonds to the non-bank public.” This method, in which the public finances the deficit, increases the government’s debt payments, but decreases the money supply by taking cash out of people’s checking accounts to buy the bonds. This was an approach the United States used during World War II, combined with tax increases, in order to keep demand and inflation down as the country’s production shifted from consumer to military goods.

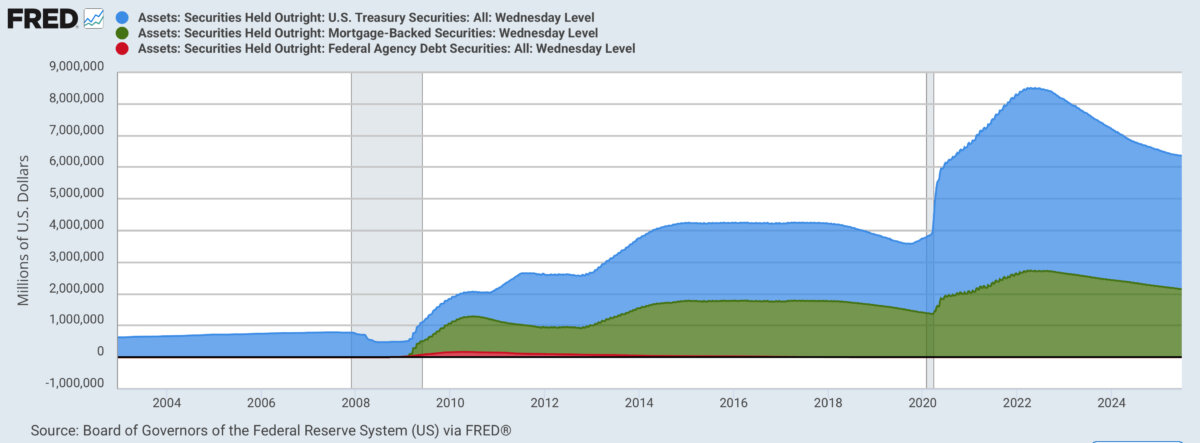

The other way to finance America’s deficit is that the Fed buys the Treasury securities, which it did by the trillions following the 2008 mortgage crisis and the 2020 pandemic. In this case, the Fed credits bank accounts with dollars in exchange for the Treasurys, thereby increasing the money supply.

“The perfect example of that option was COVID,” Hanke said.

(Source: Federal Reserve)

In the wake of unprecedented government spending following the coronavirus pandemic, during which the Federal Reserve more than doubled its holdings of bonds, from about $4 trillion to $9 trillion, consumer prices in America accelerated to a rate of 9 percent in 2022, wiping out more than 20 percent of the dollar’s value by 2024. And while MMT advocates point to supplychain disruptions as the cause of that inflation, other economists argue that even when supply chains returned to normal levels, prices did not come back down.

This experience has undermined many of the proponents of MMT, particularly those who argued that the risk of budget deficits should not limit America’s spending on programs like the Green New Deal and Medicare-for-all. “They were riding very high for a while,”

“They’ve kind of retreated into the shadows now, but they’re not gone. “Their crackpot theories never hold water, but they remain around the fringes nevertheless,” he said.

Click here for the full article

Steve Hanke is a Distinguished Senior Scholar at the Mises Institute and a Professor of Applied Economics at the Johns Hopkins University. He can be followed on X @steve_hanke.