OAN Staff Brooke Mallory

1:49 PM – Thursday, May 22, 2025

House Republicans narrowly passed President Donald Trump’s “Big, Beautiful” bill on Thursday morning, advancing it to the Senate — following an intense 48-hour effort to reconcile the priorities of fiscal conservatives and moderates from blue states.

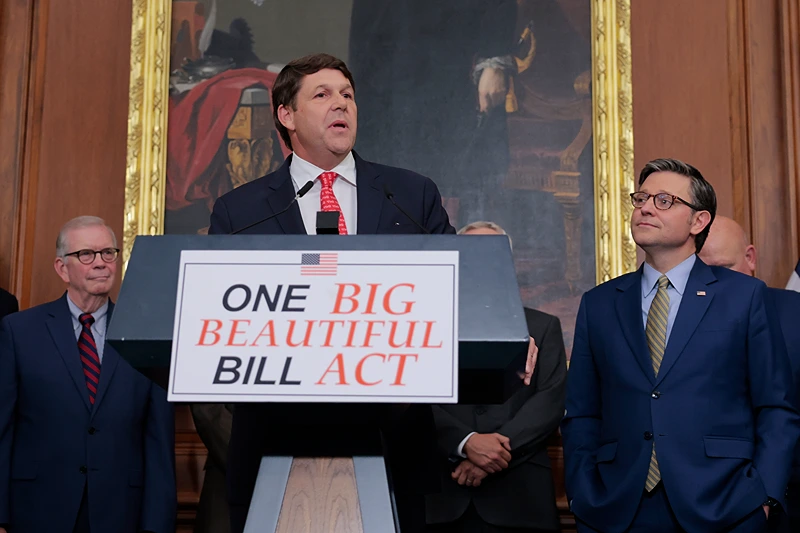

The 215–214 vote allowed lawmakers to meet House Speaker Mike Johnson’s (R-La.) target of securing passage before the Memorial Day recess. However, the bill now faces heightened uncertainty in the Senate, where Republicans are pushing for deeper spending cuts while simultaneously seeking to maintain existing Medicaid provisions.

“My friends it quite literally is, again, morning in America,” Johnson said in a speech before the vote.

Advertisement

“This One Big Beautiful Bill is the most consequential legislation that any party has ever passed, certainly under a majority this thin,” he continued.

As far as GOP dissenters go, Rep. Warren Davidson of Ohio and Thomas Massie of Kentucky voted against the motion — along with 212 other Democrats. Rep. Andy Harris (R-Md.), who leads the House Freedom Caucus, simply voted “present.”

Harris and Texas Rep. Chip Roy (R-Texas) led a group of Freedom Caucus defectors who attempted to obstruct the package less than 24 hours before the final vote — forcing Trump to meet with them at the White House Wednesday afternoon.

According to Johnson, that prompted a few informal agreements on new executive actions or legislation as he returned to Capitol Hill.

“I voted to move the bill along in the process for the President. There is still a lot of work to be done in deficit reduction and ending waste, fraud and abuse in the Medicaid program,” Harris said on Thursday.

GOP holdouts rejected the bill for postponing Medicaid work rules until 2029 and preserving green-energy tax credits from the last Biden administration — according to the New York Post.

“It has massive deficits in the first five years because we’re not addressing the structural reform that we’re talking about right here,” Roy asserted, “including very specifically eliminating the 45% of the subsidies under the Green New Scam that continue.”

Blue-state Republicans, including New York Representative Mike Lawler, secured a last-minute agreement—reached just hours before the Freedom Caucus revolt—to raise the state and local tax (SALT) deduction cap to $40,000 for individuals and $20,000 for married couples filing separately, provided their incomes do not exceed $500,000 and $250,000, respectively.

The final “Manager’s Amendment” incorporated this provision, while also accelerating the implementation of Medicaid work requirements to no later than December 31, 2026. It rescinded tax credits for wind, solar, and battery storage facilities that begin construction more than 60 days after the bill’s enactment or commence operations after December 31, 2028.

Johnson later remarked that the GOP tally would have reached 217 votes had Representative David Schweikert (R-Ariz.) not cast his vote prematurely and Representative Andrew Garbarino (R-N.Y.) not inadvertently missed the vote, reportedly having “fallen asleep” in the chamber.

“I’m going to just strangle him,” the House speaker said jokingly at a press conference after its passing. “But he’s my dear friend.”

Meanwhile, GOP Rep. Garbarino played a pivotal role in brokering the SALT-related compromise among Republicans, which raised the state and local tax deduction cap—a key concession for members from high-tax states—while also opposing certain green energy rollbacks championed by the Freedom Caucus.

The legislation approved on Thursday extends the 2017 Trump-era tax cuts and temporarily suspends taxes on qualified tips, overtime wages, and auto loan interest. However, it stops short of eliminating taxes on Social Security benefits, instead offering seniors an enhanced deduction.

Additionally, the bill allocates several hundred billion dollars in increased funding for border security and national defense, while reclaiming portions of green energy subsidies enacted under former President Joe Biden. It also maintains the revised $40,000 SALT deduction cap, a provision critical for Republicans representing blue-state constituencies such as New York and California.

“’THE ONE, BIG, BEAUTIFUL BILL’ has PASSED the House of Representatives!” Trump said in a Thursday Truth Social post.

“Great job by Speaker Mike Johnson, and the House Leadership, and thank you to every Republican who voted YES on this Historic Bill! Now, it’s time for our friends in the United States Senate to get to work, and send this Bill to my desk AS SOON AS POSSIBLE! There is no time to waste,” he continued.

“The Democrats have lost control of themselves, and are aimlessly wandering around, showing no confidence, grit, or determination,” he added. “They have forgotten their landslide loss in the Presidential Election, and are warped in the past, hoping someday to revive Open Borders for the World’s criminals to be able to pour into our Country, men to be able to play in women’s sports, and transgender for everybody. They don’t realize that these things, and so many more like them, will NEVER AGAIN happen!”

Johnson also seized the opportunity to tout his legislative win while responding pointedly to his critics — among them House Minority Leader Hakeem Jeffries (D-N.Y.), who used his allotted “magic minute” on the floor to criticize the bill’s tax breaks and other spending reductions.

The GOP Speaker praised Rules Committee Chairwoman Virginia Foxx (R-N.C.), lauding her as the “Iron Lady” of the House Republican conference for her firm leadership in managing the deluge of Democrat amendments aimed at delaying the bill’s progress to the floor.

Other significant provisions of the bill:

- Raising the cap on the State and Local Tax (SALT) deduction to $20,000 for married individuals filing separately (subject to a $250,000 income threshold) and to $40,000 for all other filers (with a $500,000 income cap).

- Increasing the federal debt ceiling by $4 trillion.

- Allocating $175 billion for border security, including $46.5 billion specifically earmarked for the construction of a wall along the U.S.–Mexico border.

- Appropriating an additional $150 billion for national defense, with specific allocations including $25 billion for President Trump’s proposed “Golden Dome” missile defense system, $34 billion to enhance naval capabilities and shipbuilding, $21 billion to replenish the nation’s ammunition reserves, and $5 billion dedicated to border enforcement.

- Instituting a monthly 80-hour work requirement — which may include employment, volunteer service, or education — for able-bodied adults aged 19 to 64 as a condition for Medicaid eligibility.

- Expanding Supplemental Nutrition Assistance Program (SNAP) work requirements to include able-bodied, childless adults up to age 64.

- Establishing an expedited permitting process for natural gas projects, contingent upon applicants contributing either 1% of the project’s total cost or $10 million, whichever is less.

- Repealing the Biden-era directive mandating that two-thirds of new vehicle sales be electric by 2032.

- Introducing federally backed “Trump” savings accounts for children born between January 1, 2025, and January 1, 2029, with an initial government contribution of $1,000 per account.

Stay informed! Receive breaking news blasts directly to your inbox for free. Subscribe here. https://www.oann.com/alerts