Last week, I noted that in spite of mounting pressure on Fed Chairman Jerome Powell and the FOMC to cut the target policy interest rate, the Fed absolutely should not do it. Although Powell claims that current monetary policy is restrictive, this is not the case. Indeed, following an injection of more than five trillion dollars into the economy since early 2020, the last thing we need is even more Fed intervention in the economy to add even more liquidity. I wrote:

Moreover, if the Fed pushes for lower rates right now—which requires more money creation from the FOMC’s open market operations—then the Fed will be “loosening into inflation.” That is, the Fed will be adopting looser, more inflationary monetary policy at the same time that there is an upward trend in price inflation. Not only are CPI and PPI prices accelerating again, but the US is in the midst of a meltup with the S&P 500 near all-time highs, with gold, crypto, and more all ripping to new highs. This is not an economy with too little liquidity. This is an economy with trillions of dollars from the covid-era mega-inflation still sloshing around the economy.

Let’s look a little more closely at the CPI and PPI situation to see what’s going on with the Federal government’s own official numbers on price inflation.

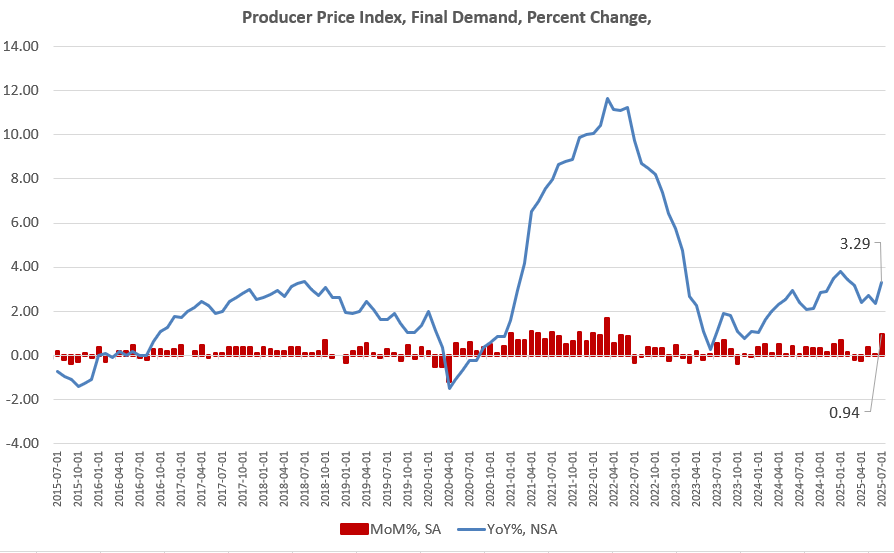

Last Thursday, the BLS released a new report showing that producer prices surged in July. The producer price index (PPI) rose by 0.9 percent, month over month, during July. That’s the largest MoM increase since March of 2022, and it’s the seventh largest increase in PPI in more than fifteen years. The year-over-year increase in the PPI also rose to a five-month high, rising by 3.3 percent, year over year.

In the first graph, we can see a generally upward trend in year-over-year changes to PPI, and the month-to-month change suddenly surged in July.

The Media has been inclined to blame this all on tariffs, but it’s extremely unlikely we’d see such clear upward movement in prices if there were not also excessive liquidity allowing purchasers to continue to bid up prices across the board.

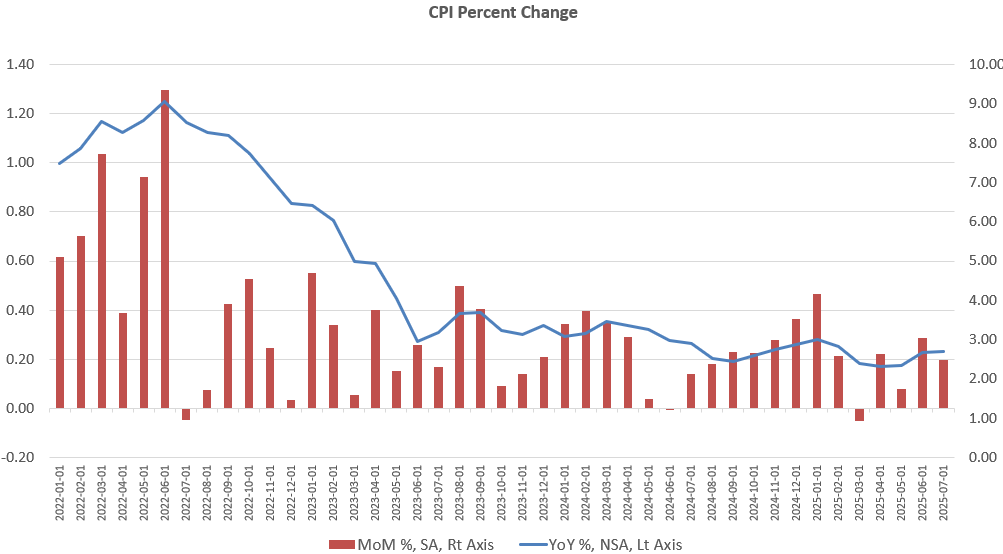

Moreover, consumer prices continue to stubbornly resist a quick or significant shift downward, even as the employment situation continues to stagnate. Specifically, the BLS’s CPI report for July shows that the year-over-year change to the CPI rose again in July to 2.7 percent. The YoY CPI has now risen three months in a row. Measured month over month, the CPI has risen four months in a row, with the CPI up by 0.2 percent from June to July.

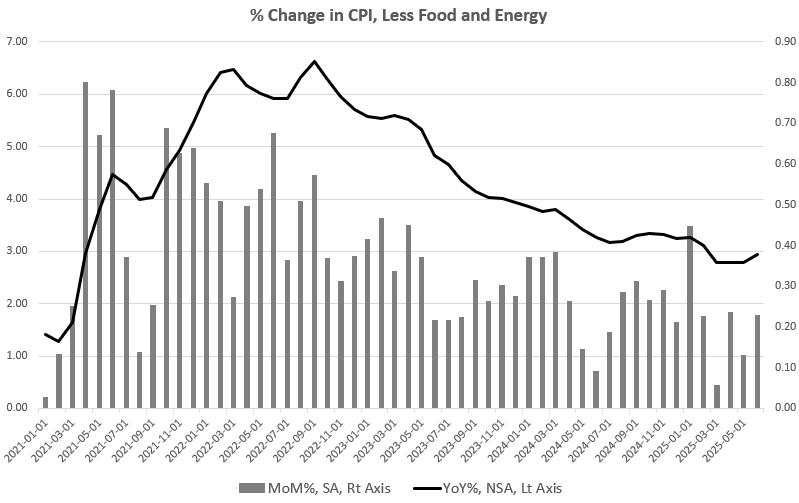

Looking to the CPI minus volatile food and energy prices—i.e., core CPI— we find a similar trend. Year over year, Core CPI rose 3.1 percent in July. That was a five-month high. Month-to month, core CPI rose to a six-month high of 0.32 percent.

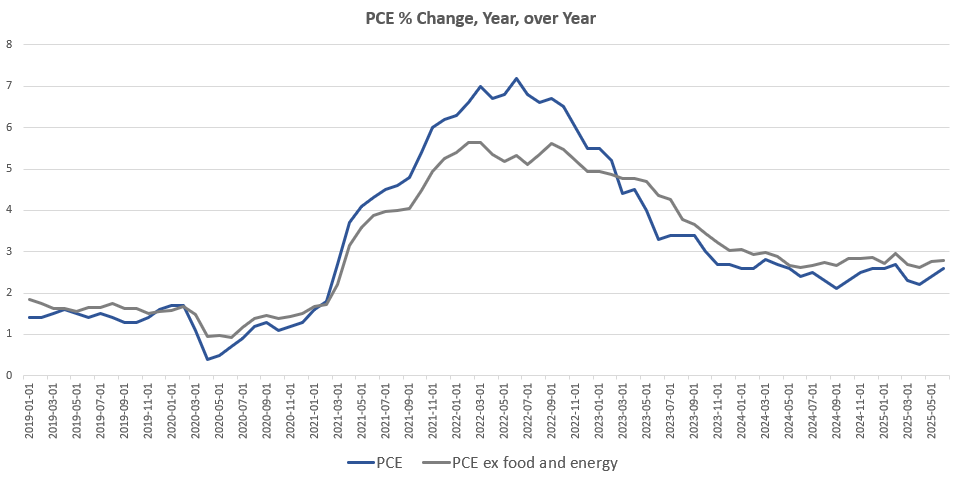

The most recent data from the Fed’s favorite measure of price inflation, PCE, also shows stubborn price inflation. The BLS reports that PCE price inflation is heading upward, as well. In June, PCE increased by 0.3 percent, month over month, and that’s the largest monthly increase since February. In fact, the monthly PCE growth has gotten larger each month since February. The same is true of PCE excluding food and energy.

Looking at the PCE’s year-over-year change, we find a similar trend. During June, PCE growth was up by 2.6 percent, year over year. That’s up from May’s growth rate of 2.4 percent, and June’s growth is the largest since February. PCE growth minus food and energy also came in at a four-month high, rising to 2.8 percent (or 2.79 percent), up from May’s measure of 2.75 percent. In spite of the Fed’s confident claims about price inflation falling to the two-percent target last fall, monthly PCE growth has changed little since April of 2024.

Recent lackluster data on jobs in recent months strongly suggests upward wage pressure is gone for now. Meanwhile, rents and home prices are softening in much of the country. So, we should not be seeing new six-month highs in any of the price index numbers. But, there is still so much overhang in monetary inflation from recent years that we continue to see upward pressure in prices in both consumer goods and producer goods.

Trump and his allies—including Governors Waller and Bowman who voted on the FOMC for a rate cut last month—seem to think that a four-month high in PCE growth somehow means the Fed should start pushing easy money yet again. Unfortunately, what we need from the Fed is for it to disengage, step back, and stop intervening to ensure a limitless supply of easy money. Stagflation continues to be a real risk, as showed by Bloomberg last week, and yet another cut to the target policy rate is likely to put more stress on consumers who—thanks to central bankers—are struggling to deal with the dollar losing nearly 25 percent of its purchasing power over the past five years.