Are tariffs appearing in the inflation data?

Is President Donald Trump’s trade policy all set up? Not quite. It appears that the administration still has a few tricks up its sleeve when it comes to reshoring domestic manufacturing and taking greater control of the international supply chain. While Trump is allowing the levies on US trading partners to travel through the global economy, the president will also target critical materials essential to today’s high-tech world.

Tariffs for a Bag of Chips

On his way to Alaska for his meeting with Russian President Vladimir Putin, Trump told reporters aboard Air Force One on August 15 that he planned to announce new tariffs on imports of chips and semiconductors soon. According to the president, the levies will start low but then increase to as high as “200%, 300%” if companies do not open factories in the United States. Scores of domestic and foreign companies, from Nvidia to TSMC, have committed hundreds of billions of dollars in US artificial intelligence (AI) chip manufacturing over the next few years.

This week, Trump engaged in good old-fashioned state capitalism by granting export licenses for Nvidia and Advanced Micro Devices (AMD) in exchange for a 15% fee of revenues from the sale of chips to China. Additionally, reports circulated that the administration is pursuing a stake in Intel, sending shares of the chipmaker as high as 7%.

Meanwhile, President Trump also revealed to the press that he will announce more trade penalties on steel. It is unclear if he will introduce a new round of import duties or raise the current tariff regimes. Trump initially implemented 25% levies on aluminum and steel imports to bolster domestic production. This past spring, he confirmed he would raise the rate to 50%.

Calm Before the Storm

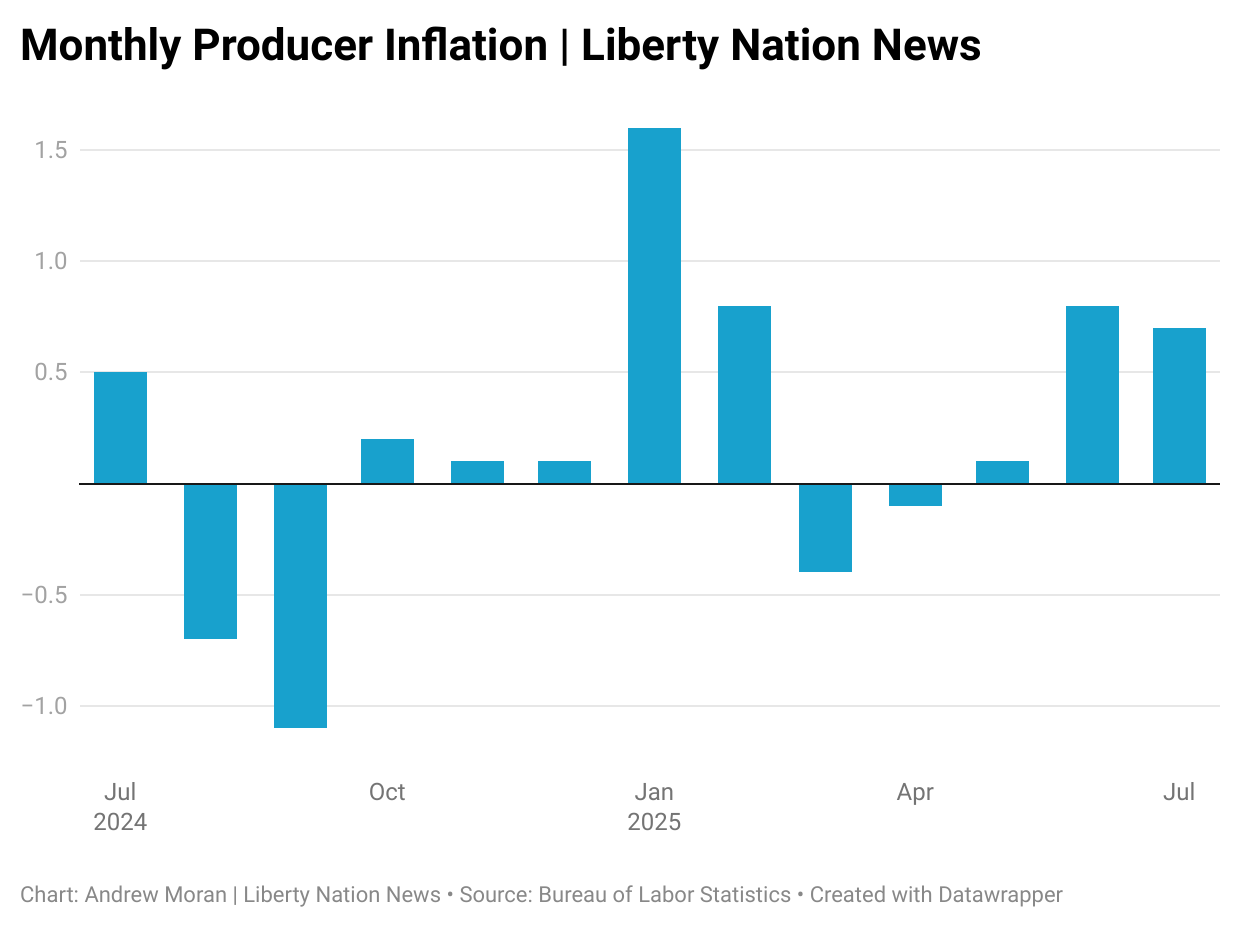

The July Consumer Price Index (CPI) was relatively soft, indicating that tariffs were having a minimal impact on inflation. The narrative quickly shifted when the Bureau of Labor Statistics published the Producer Price Index (PPI) and trade prices for July.

First, wholesale inflation unexpectedly soared 0.9% last month, and core producer prices (excluding food and energy) also spiked 0.9%. Second, import prices rose at a higher-than-expected pace of 0.4%, while export prices increased by 0.1%. These readings immediately sparked a fierce response from critics, who averred that the president’s levies were triggering renewed price pressures. However, a deeper dive presented a slightly different understanding of the numbers.

Like the CPI, the PPI and import prices were primarily driven by services inflation, which could be a dangerous trend for the US economy. While prices for goods did increase, it was the services side of the equation that contributed to a lion’s share of the jump in key pipeline inflation indicators.

Like the CPI, the PPI and import prices were primarily driven by services inflation, which could be a dangerous trend for the US economy. While prices for goods did increase, it was the services side of the equation that contributed to a lion’s share of the jump in key pipeline inflation indicators.

Indeed, the US economy is not out of the woods yet when it comes to “tarifflation.” However, it may turn out that services could lead to persistent inflationary challenges, mainly because it is far stickier than goods, and the Federal Reserve cannot do anything about it. So, what has caused this new trend?

Housing is a significant component of services, which is why monetary policymakers will examine supercore inflation as it excludes housing from the calculations. Moreover, as immigration policy changes and the labor pool shrinks, companies will have to offer higher wages to attract candidates. And, yes, tariffs will force firms in areas such as equipment maintenance and logistics to pass on higher costs to their customers.

Fed Up Over Trade Taxes

Despite the two hot inflation readings, investors still anticipate the Federal Reserve will lower interest rates at next month’s Federal Open Market Committee by 25 basis points amid concerns over a deteriorating labor market. Of course, a lot could happen between now and September 17 – the Eccles Building still needs digest the August jobs report and another batch of inflation readings.

However, it is a case of picking your poison at this juncture. On the one hand, the US central bank can cut interest rates and risk higher inflation. On the other hand, maintaining a tight monetary policy could threaten the already weakening labor market. Chicago Fed President Austan Goolsbee may have said it best in an August 16 interview with CNBC: “We’ve got to get some clarity from the numbers.” And this has yet to happen.

Liberty Nation does not endorse candidates, campaigns, or legislation, and this presentation is no endorsement.