During the 2024 election, President Donald Trump teased that he would eventually eliminate the income tax. A couple of months into his second term, Commerce Secretary Howard Lutnick suggested that the president would scrap the income tax for those earning under $150,000. Trump is back again, proposing a landmark pledge of no income tax for hard-working Americans.

No Income Tax for America

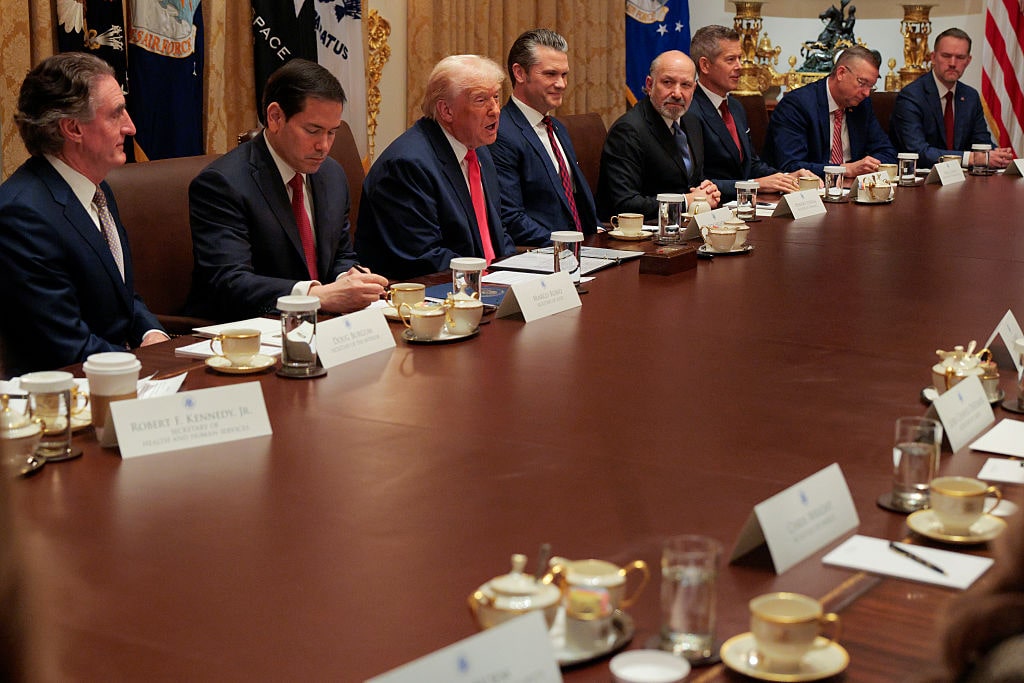

The latest must-watch Cabinet meeting featured many knee-slapping moments, from a rant about Somali immigrants to members appearing fatigued when Secretary of State Marco Rubio spoke. But a key moment came when Trump suggested that Americans may “not even have income tax to pay” in the near future, citing tariff income to offset the loss of revenue from the federal income tax.

“I believe at some point in the not too distant future, you wouldn’t even have income tax to pay because the money we’re taking in is so great,” Trump told reporters on Dec. 2. “It’s so enormous that you’re not going to have income tax to pay. Whether you get rid of it or just keep it around for fun or have it really low, much lower than it is now, but you won’t be paying income tax.”

The president made a similar comment during the holiday weekend. “Over the next couple of years, I think we’ll be cutting income tax – could be almost completely cutting it, because the money we’re taking in is going to be so large,” Trump told service members in a Thanksgiving video.

Is it possible? Legislatively, the administration might embark upon a Sisyphean endeavor. Economically, putting the kibosh on a monetary penalty on labor cannot be done without first addressing the current fiscal mess that has plagued Washington for the past 40 years.

Crunching the Dollars

First, the headline numbers. America’s national debt is $38 trillion. The US government registered a $2 trillion budget deficit in fiscal year 2025. In October, Washington posted a $284 billion shortfall, a record for the month. Annual interest payments have topped $1 trillion. The ocean of red ink is happening even as Uncle Sam collects more than $5 trillion in revenues per year.

To advance President Trump’s ambitious plans – such as handing out tariff rebate checks, paying down the national debt, and eliminating the income tax – the budget must be balanced first. Remember, the national debt is the accumulated result of past deficits.

Now, how much money does the nation’s capital receive from individual income taxes? According to the Treasury Department, collections totaled almost $2.666 trillion in fiscal year 2025. By comparison, customs duties were about $200 billion. So, for a government that is routinely running deficits with no sign of improvement, every dollar counts, it seems.

For those who loathe the idea of working for the state five months of the year, here is a tragic tale. One quarter of all income tax revenues is dedicated to merely paying the interest on America’s debt. As anyone holding a credit card balance or a mortgage can attest, covering these costs can be painful since they do not contribute to anything worthwhile.

Tariff rates would need to rise dramatically to offset the loss of income tax collections. International trade has recovered from the tariff tumult from Liberation Day in April; anything significantly higher would trigger something worse than the world went through this past spring.

But the government has other options. First, borrow more money to finance spending, which would increase the national debt and potentially raise interest rates. Second, shrink the size of the Leviathan, but this also means reducing mandated outlays, such as Social Security and Medicare. Does anyone have the appetite for this?

Only a Dream

Some of the greatest minds, leaders, and ideas of the 20th century were adamantly opposed to the income tax and over taxation in general.

Former President Calvin Coolidge, one of the most underrated US presidents, said in 1925 that over taxation is “legalized larceny.” The Laffer Curve shows that the higher the income tax, the less revenue is garnered. Economist Frank Chodorov stated in the 1950s that the income tax was the “root of all evil,” writing:

“An evil is not only something that is done to us; more often, it is something we do to ourselves, consciously or by way of weakness. A drunkard may acquire his bad habit from his associates or he may bring it on without outside influence.”

Removing this stain from the world’s largest economy would be terrific. However, it can only be done by abolishing most of what the government does, changing the public’s perception of the state’s role, and balancing the budget. Until then, the income tax will live – and live again.

Liberty Nation does not endorse candidates, campaigns, or legislation, and this presentation is no endorsement.