‘Exit, voice, loyalty’ in action as Cape Cod Potato Chips flees Massachusetts

Low-tax, Republican-leaning states are gaining people, while higher-tax, Democrat-leaning states are losing them, according to new domestic migration data released this week by the U.S. Census Bureau.

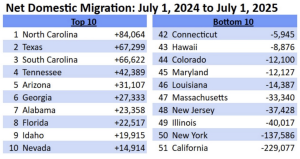

Unleash Prosperity, a pro-growth advocacy group that parsed the data, listed North Carolina, Texas, South Carolina, Tennessee, and Arizona as the states with the largest net domestic migration gains, with California, New York, Illinois, New Jersey, and Massachusetts hemorrhaging people.

A former White House spokesman for President George W. Bush, Ari Fleischer, noted the political implications. “Trump won the top 10 states that are gaining the most population. Harris won the top 10 states that are losing the most population. Not a good sign for the D future,” he commented.

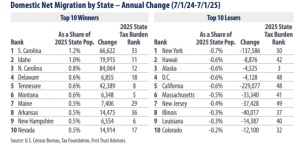

First Trust, an investment firm whose chief economist is supply-sider Brian Wesbury, did its own analysis, looking at percentage change rather than absolute numbers, and also listing Tax Foundation data on tax burden. “Where 1 is the least tax-burdened state and 50 is the most tax-burdened state, the top 10 domestic migration winners boasted an average tax burden ranking of 18. In contrast, the top 10 domestic migration losers exhibited an average tax burden ranking of 39,” First Trust said.

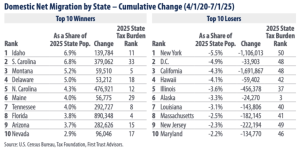

First Trust also did a five-year analysis showing New York and California losing more than one million people each over that span to net domestic migration.

First Trust also did a five-year analysis showing New York and California losing more than one million people each over that span to net domestic migration.

As if to put an exclamation point on those trendlines, a series of news headlines over the past week portrayed some of the loser states as, well, losers.

As if to put an exclamation point on those trendlines, a series of news headlines over the past week portrayed some of the loser states as, well, losers.

Massachusetts swallowed the news that Cape Cod Potato Chips is closing its factory in Hyannis, where the brand was founded, and moving production to alternative locations, including Charlotte, N.C.

In New York, Mayor Zohran Mamdani discovered a $12 billion budget shortfall, which he seized on as a reason that the state should raise taxes even more. Ten people died as Mamdani mishandled a snowstorm. Mamdani’s predecessor, Eric Adams, mocked the mayor on social media: “When you promise ‘free’ everything on Sunday, boldly declare that millionaires and billionaires shouldn’t exist on Monday, and by Tuesday you’re scrambling to fund your giveaways with the very people you wanted gone just yesterday.” Mamdani has promised free buses and free childcare. Adams said, “‘Free’ is a lie. Every so-called free program comes with a price tag, and someone always pays for it.” (One thing the cash-strapped city is not skimping on: access to left-leaning media. The New York Public Library on Jan. 29 announced “free unlimited access to The New York Times online, with no library card or login required,” meaning that New York residents will now be able to access all the anti-Israel blood libels at taxpayer expense.)

The president and CEO of the Partnership for New York City, a business group, Steven Fulop, replied to Mamdani, “Let’s move past the relocation debate over taxes – people can argue that forever. The real question is simple: if you were starting or scaling a business today, would you choose NYC if these trends continue? According to the Citizens Budget Commission: NYC already has the highest combined corporate tax rate in the country at 17.44%. … Companies may not leave overnight, but they will stop expanding here.”

Other Democrat-dominated states are pursuing policy plans that seem aimed at driving out job creators. In Providence, R.I., the City Council is backing a cap on rent increases, though the city’s mayor, Democrat Brett Smiley, has threatened to veto it on the sensible grounds that price controls would slow construction of additional apartments and houses. Rhode Island’s Democratic governor Dan McKee is proposing a new 8.99 percent tax bracket for income over $1 million starting in tax year 2027. Texas, New Hampshire, Nevada, and Florida have zero state income tax.

House seats and electoral votes are allocated on the basis of population, and while overall population figures are affected by international migration and also by death and birth rates, the flow of people from state to state may work to the political advantage of Republicans, especially as immigration to America slows under Trump administration policies.

Beyond the partisan politics of it, the numbers point to a dynamic in some states where people have given up on reform and decided to pick up and leave instead. Economist Albert Hirschman is known for his “Exit, Voice, and Loyalty” framework, outlined in Hirschman’s 1970 book of that name and in Editors posts such as “The Talmud on Moving Out of a City to Avoid Taxes,” July 4, 2024, and “Prairie State spending soars,” April 1, 2024, and in a series of posts at our predecessor site FutureOfCapitalism.com, including “Exit, Voice, and Loyalty,” Dec. 2, 2018. Hirschman is a character in the Netflix series Transatlantic. The basic argument is that people are loyal up to a point and will use their voices to advocate for change, but when they feel their voice is not being heard, they leave, or “exit.” In the context of public schools, for example, parents may volunteer or complain or come to meetings, but at a certain point, if things don’t improve, they may pull their children out of school and enroll them in a private or charter school, or move to a different public school district.